California’s Senate Bill 261 (SB 261) has officially taken effect. If your company has revenue, operations, or transactions in California, this law likely applies to you and you must begin preparing climate-related financial risk disclosures today in order to meet the January 1, 2026 deadline.

Who Needs to Comply?

SB 261 applies to any company other than insurers with yearly global revenue greater than $500 million that does business in California.

California law defines “doing business” broadly. You are considered to be doing business in the state if any one of the following is true:

- Sales in California: exceed the lesser of: $735,019 (2024 threshold), or 25% of your total sales.

- Property in California: exceed the lesser of $73,502, or 25% of your total property.

- Payroll in California: exceed the lesser of: $73,502, or 25% of your total payroll.

- Actively engaging in transactions for financial gain in California

Even without hitting thresholds, a single sale or ongoing transaction for profit in the state can trigger compliance.

How Do I Comply With SB261?

Companies "doing business" in CA must prepare and publish a Climate-Related Financial Risk Report every two years. The first is due January 1, 2026.

This report must:

- Identify climate-related financial risks: Both physical risks (wildfires, floods, extreme heat, storm surge, drought) and transition risks (policy, market, technology shifts).

- Use a recognized framework: Reports must align with the Task Force on Climate-Related Financial Disclosures (TCFD) or an equivalent standard.

- Detail mitigation and adaptation measures: Companies must show how they are reducing risk exposure and building resilience into their operations and assets.

- Be made public: Reports must be posted on the company’s website and updated every two years.

Regulators will expect disclosures to be quantitative, scenario-based, and decision-useful. Vague ESG commitments will not satisfy.

Why the Urgency?

- Deadline pressure: January 1, 2026 may seem distant, but building robust climate reporting processes takes time. Companies starting now will avoid last-minute compliance risks.

- Financial exposure is real: Climate hazards are already impacting balance sheets. Insurance in high-risk regions is becoming unaffordable or even unavailable. This increases borrower default risk, reduces asset values, and exposes companies to unexpected financial losses.

- Regulatory momentum is accelerating: SB 261 is part of a broader wave of climate disclosure requirements, from the SEC’s proposed rules to Canada’s OSFI guidelines and EU’s CSRD. Compliance in California will prepare your business for global alignment.

How Does Climatecheck Help Me Comply?

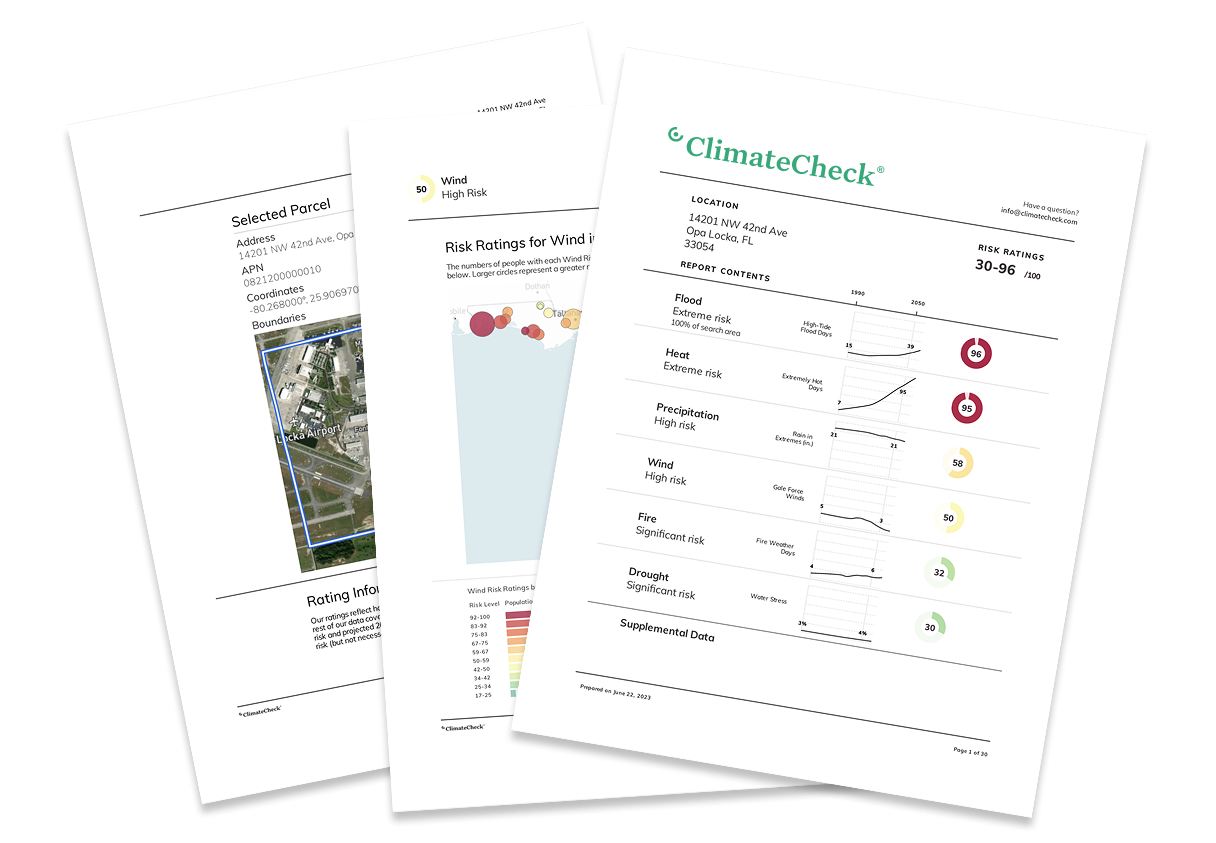

ClimateCheck delivers the physical climate risk tools you need:

Climatecheck's data is easy to integrate into your existing processes via API, dashboards, spreadsheets, or custom integrations.

- Portfolio assessment and scenario modelling: understand your strategic opportunities for risk mitigation and resilience to build into your adaptation plan.

- Property reports: build property level data into your due diligence processes as part of your long-term mitigation plans.

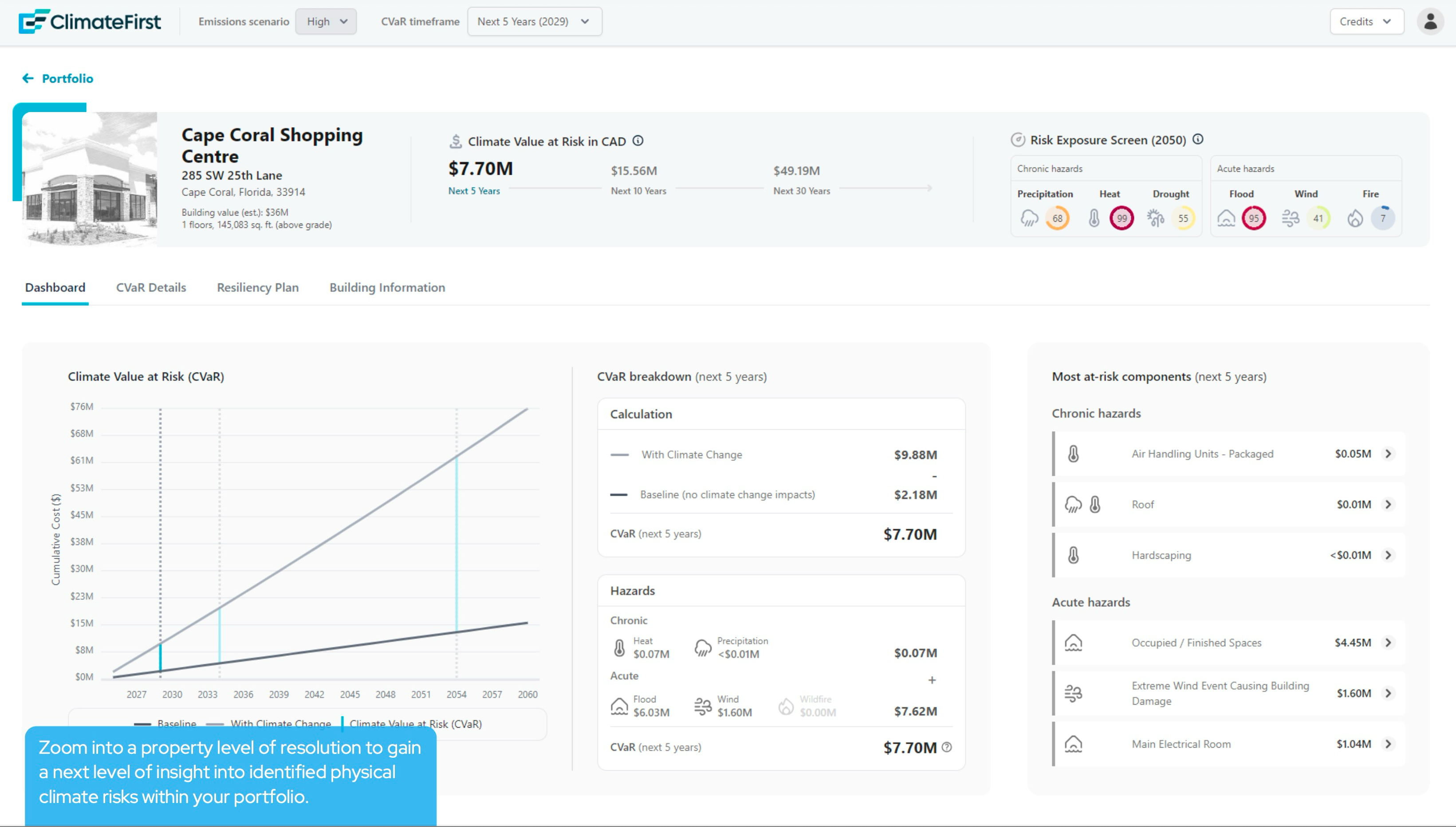

- Climate Value at Risk Analysis: use actionable financial metrics for capital planning and build system level resilience for your properties through with the best Climate Value at Risk analysis through our partnership with ClimateFirst:

Summary

If your company meets the thresholds for doing business in California, SB 261 applies to you.

- The deadline for the first report is January 1, 2026.

- Reports must be public, TCFD-aligned, and quantitative.

- Companies that act now will not only meet compliance requirements but also gain an advantage in managing real climate-related risks to their business.

ClimateCheck is here to help you prepare, comply, and stay ahead. Contact us as on our website https://climatecheck.com or email us at info@climatecheck.com