As hurricanes, tropical storms, heavy rains, and even heavy snowfall become more intense due to climate change, flooding happens more intensely—and in places it hasn’t happened before. But one of the primary tools governments, insurers, property owners, and investors use to understand their flood risk looks to be increasingly unreliable.

Flood maps provided by the Federal Emergency Management Agency (FEMA) are an important tool for responding to flood risk. In addition to informing people about flood risk to property, the maps serve as a basis for the rating of flood insurance policies and inform development and permitting in communities. However, the maps may not capture accurate data about flood risk across the continent, and that can lead to investors, property owners, and others making decisions based on incomplete information.

FEMA flood maps can include outdated information and incomplete data, and they only track some types of flooding. Investment firms, environmental consultants, and the U.S. Government Accountability Office alike are calling for more comprehensive methods for predicting flood risk that go beyond what FEMA flood maps currently provide. ClimateCheck uses a wide range of statistical models and climate data sources to paint a more accurate, complete picture of risk for real estate investors and real estate investment trusts (REITs).

FEMA flood map limitations

FEMA flood maps are created using a patchwork of localized maps. This fragmentation can result in inconsistency, and some local maps may be inaccurate, incomplete, or out of date.

“Much of FEMA’s continental-scale flood mapping has been done locally, which is a more detailed and hopefully more accurate process. But the accuracy is not going to be the same everywhere,” said ClimateCheck Head of Climate Risk Modeling Max Stiefel. “FEMA hasn't mapped all of the U.S., and some of the maps are outdated enough where they don't represent the current nor projected flood hazard.”

For example, a California Department of Water Resources assessment found that although FEMA’s flood insurance rate maps (FIRMs) are supposed to be updated every five years, the studies supporting existing FIRMs are over 20 years old. When FEMA updates maps, individuals or communities may appeal to have their properties included in or excluded from high-risk areas based on insurance coverage and premium rates, Stiefel says.

FEMA’s maps also omit certain types of flooding, such as pluvial flooding. As extreme weather events like hurricanes and heavy rains become more intense due to climate change, the data FEMA does have becomes less useful for predicting where flooding will occur in the future. Plus, because FEMA flood maps are created based on where flooding has already occurred, not where it may happen in the future, they’re less useful for creating climate risk reports needed by property owners, investors, and REITs to assess flood risk.

ClimateCheck’s comprehensive flood risk projection

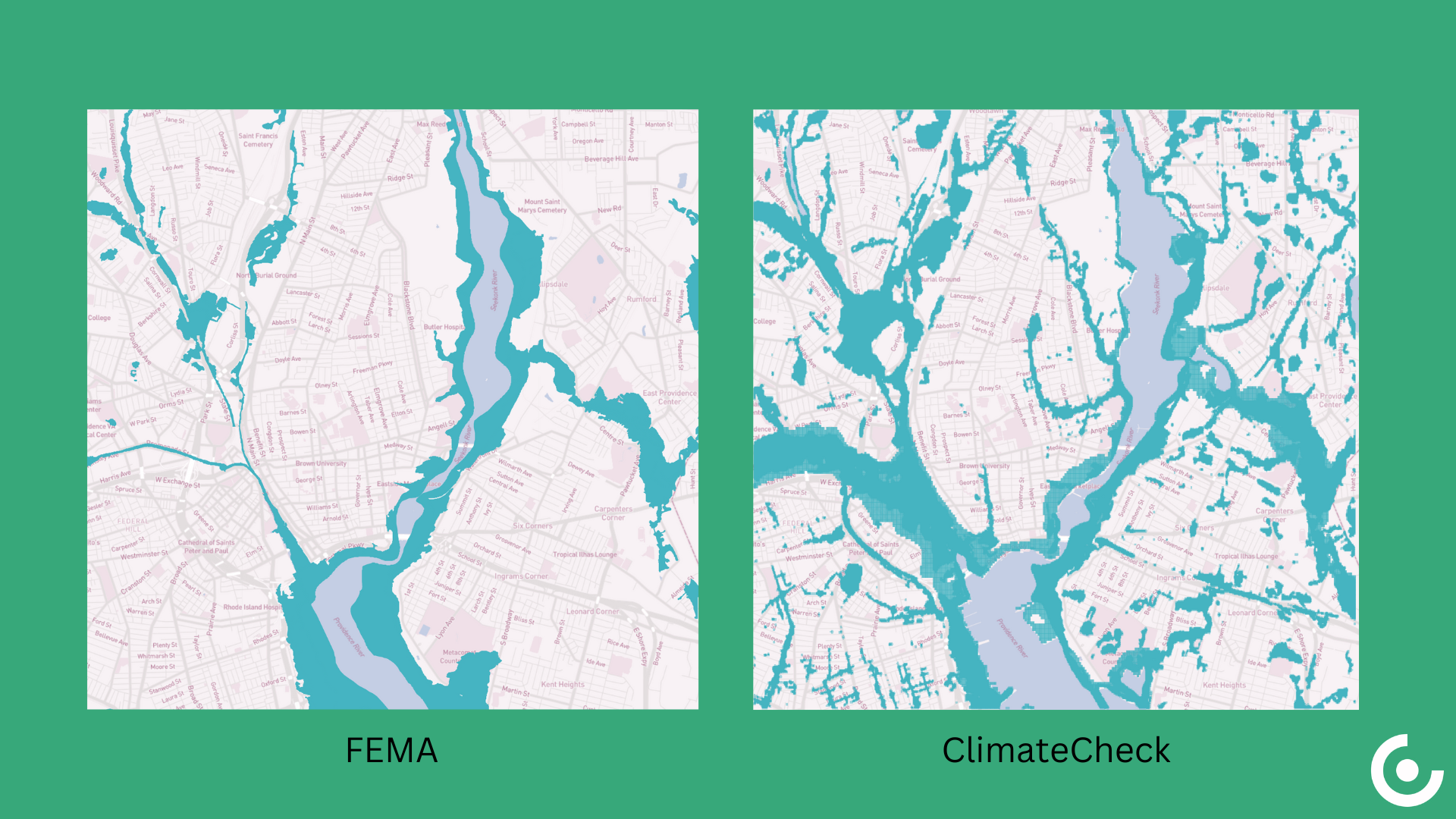

ClimateCheck’s flood risk projections look different from FEMA flood maps because, while ClimateCheck incorporates FEMA flood data into our assessments, ClimateCheck also incorporates data from other government, academic, and institutional sources like the Intergovernmental Panel on Climate Change (IPCC) and the United States Geological Survey (USGS) to create a more accurate, comprehensive assessment for real estate investors. Our use of IPCC and other data enables us to project how different climate scenarios will change flood risk over time — something current FEMA flood maps don’t do.

“Our maps look different from FEMA’s because we include additional models in producing our flood hazard estimates,” Stiefel says. “We use a physical inland flood model called CADDIES, plus a machine learning model trained on FEMA flood data.”

ClimateCheck’s comprehensive climate risk assessment rates flood risk by modeling depth of fluvial (riverine), pluvial (surface), storm surge and high-tide flooding—some of which are not included in FEMA flood maps depending on the location. Drawing on historical records and projections through 2050, real estate investors and REITs can use these insights to inform their investment strategies.

The image on the left is a depiction of potential flooding in Providence, RI based only on FEMA flood map data. The image on the right depicts projected flooding under the RCP8.5 warming scenario based on ClimateCheck's more comprehensive analysis.

The dangers of unknown flood risk

Property owners can mitigate the flood risk to their properties by taking steps like sealing walls and floors in basements, creating landscaping barriers to protect buildings from fluvial flooding or coastal storm surges, and purchasing flood insurance. Not knowing an area’s flood risk can be dangerous because property owners and investors may fail to take important steps.

In addition to the health hazards posed by contaminated floodwater and mortality risk, homes, buildings, and other property can be destroyed by flooding, endangering not only residents but also the return on investment for the property owner.

Buildings and building materials can be damaged or swept away during a flood, as can possessions inside and vehicles outside the home. Floodwater can contain contaminants like sewage, harmful chemicals, and other hazardous waste that contaminate buildings even after the water subsides. Moisture introduced by floodwater can also render homes unlivable.

Flooding can be highly destructive to communities, especially when property owners are unprepared. As climate change makes floods more intense, property owners and investors need a comprehensive understanding of their flood risk. ClimateCheck’s climate risk assessments help investors and REITs identify high-risk properties, conduct more thorough due diligence, and optimize their investment strategy. For real estate investment firms, accurate flood mapping translates to reduced risk and improved decision-making.