Can You Change Your FEMA Flood Zone?

FEMA recognizes that hydrology science sometimes makes mistakes, and also that steps can be taken to mitigate flood risk on a property. Both of these can merit a request to change your flood map. Changing your flood zone is possible through a FEMA Letters of Map Change (LMOC) form, but only in instances where your property was misidentified or there have been changes in the property’s location or elevation. Property owners can save a significant amount of money on flood insurance by making sure their flood zone accurately reflects the risk of flooding.

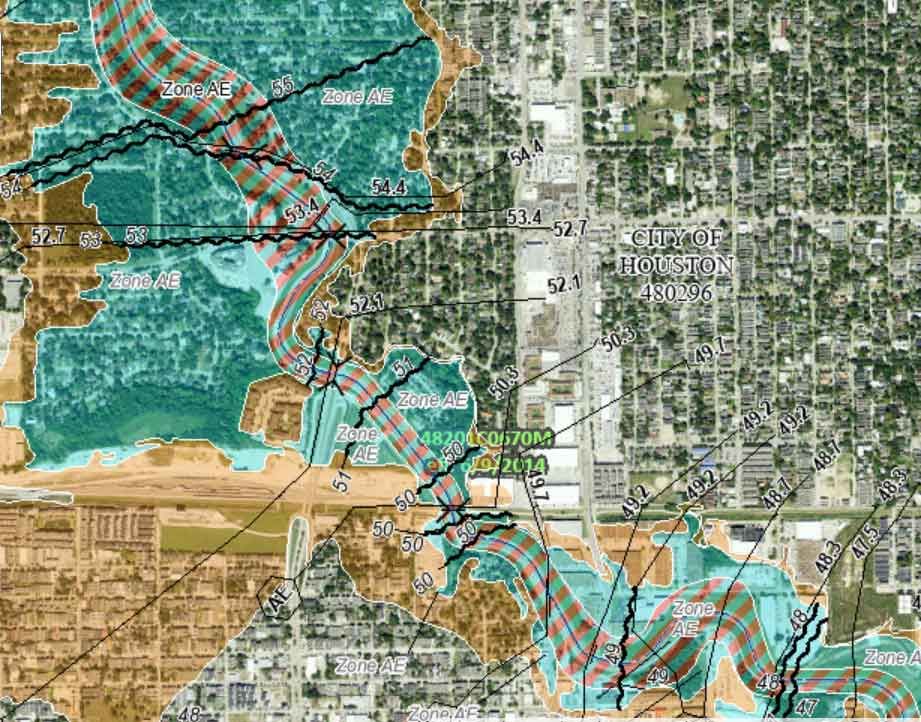

First, Check Your Your Flood Insurance Rate Map

Flood Insurance Rate Maps (FIRMs) produced by FEMA are used to determine the probability of flooding in a specific flood zone. Referencing FIRMs is the best way to see the relationship between your property and areas with the greatest risk of flooding. If you are in a high-risk flood zone (A, AO, AE, AR, A99, AH, VE, V) you are in a Special Flood Hazard Area (SFHA) with a 1% or more risk of flooding per year on average, sometimes also referred to as the base flood or one-percent-annual-chance-flood.

The flood zone designation of your house or property is important because flood zones are the basis for floodplain management regulations in your community and whether you are required to purchase flood insurance or not. Paying for insurance can be expensive, but thankfully property owners and renters have the option to petition FEMA to remove your home from a high-risk flood zone designation. The several different types of petitions are collectively called “Letters of Map Change” (LOMC).

How do you Change your FEMA Flood Zone?

Each year, FEMA studies and updates flood zone information in communities across the U.S. in order to create and revise flood hazard maps. Due to constraints in funding, FEMA can only study a limited number of communities each year. Therefore, FEMA prioritizes areas of study where there is new development or areas where the maps are most outdated. Given this, FEMA depends on communities to report changes to flood hazard information and submit technical information on any changes.

Letters of Map Change (LMOC)

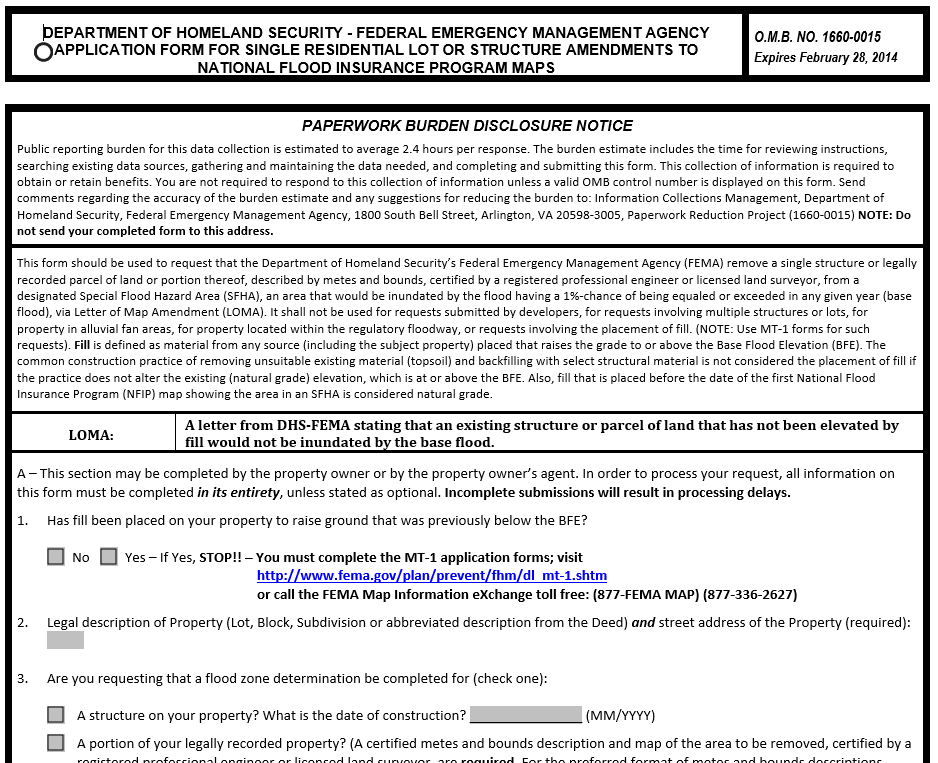

If you believe that there has been a mistake in your flood zone designation, you have the option to submit a Letter of Map Change (LOMC) Request to FEMA. This process will start a formal determination of your property’s location and elevation relative to a SFHA. FEMA generally does not revise a map that is currently effective. They will make the change if it involves a modification to SFHAs, and therefore has significant consequences for property owners and insurance rates. However, revisions that involve other information, like changes to roads, will be recorded, but not used until the next flood map update.

To submit a LOMC request, you can complete the process online or print and mail paper forms. Access to the paper forms can be found on the FEMA website. Online applications for homeowners, renters, and individuals can be submitted on the online LOMC website. Registered professionals use a different online tool, eLOMA, for submitting requests. Once submitted, LOMC requests can take between 45 and 90 days.

Types of FEMA Determination Documents

After FEMA reviews a request for changes, it issues a “determination document” which either approves or denies changing the flood map. There are two types of determination documents, and one type of conditional document:

Letter of Map Amendment (LOMA): An amendment to the currently effective FIRM which established that an existing property or structure is not located in a Special Flood Hazard Area (SFHA) due to naturally high ground which has not been artificially elevated by fill.

- LOMAs are generally used for single-lot changes that do not modify the floodplain of the FIRM, generally to remove the flood insurance requirement on either a specific property or structure.

- This type of document requires a property survey to determine that a parcel of land (property LOMA) or the base of a structure (structure LOMA) is above the base flood elevation. If the footprint of a house is expanded, a structure LOMA does not cover the additional space unless a new LOMA is approved for the expanded dimensions.

Letter of Map Revision (LOMR): LOMRs are revision to the FIRMs issued by FEMA that changes flood zones, delineations, base flood elevation, and/or wave crest elevation. LOMRs allow FEMA to revise information on FIRMs without the need to physically revise and reprint the whole map.

- LOMRs are typically used when there are major modifications to the hydrologic or hydraulic characteristics of a flood area, such as after a floodplain has been reshaped due to a major flood or after major structural flood control measures have been constructed.

Letter of Map Revision Based on Fill (LOMR-F): A FEMA statement that an existing property or piece of land has been elevated by earthen fill and would therefore not be flooded by the 1% annual flood (base flood). Similar to a LOMR, but with a focus on a single property.

Conditional Letter(s) (CLOMA, CLOMR, CLOMR-F): Similar to the other types of documents, but based on proposals for future changes on the property. This type of revision does not change flood maps; it is used primarily to notify a community that the completion of a planned infrastructure project will be likely to cause a revision in the flood map once the project is completed.

- If FEMA accepts a CLOMR, developers can be reasonably sure that a LOMR will be approved for the project area after the completion of changes to the floodplain.

- Developers submit design specifications to FEMA that show the existing pre-development flood conditions as well as floodplain alterations planned by development.

If FEMA grants a map revision request, it may mean a change in flood insurance requirements. In this case, the property owner can send their LOMA or LOMR-F to their lender and request that the federal insurance requirement be removed.

FEMA partners with National Flood Insurance Program communities to develop updated hydrologic and hydraulic modeling, mapping floodplain boundaries, digital mapping, and other data gathering. Maintaining up-to-date flood maps is a collaborative effort, which means that communities have the ability to quickly notify FEMA of any changes, especially when it would be a change of the type of flood zone.

Conclusion

The FEMA process for mapping flood zones allows modifications through individuals and collaboration with community partners. Although it can be a complicated process, submitting documentation to FEMA to change your flood zone status can save you a lot of money that would otherwise be spent on flood insurance. LOMC options that require adding fill to a property or creating flood barriers can also help reduce your total amount spent on flood damage repairs.