What are FEMA Flood Zones?

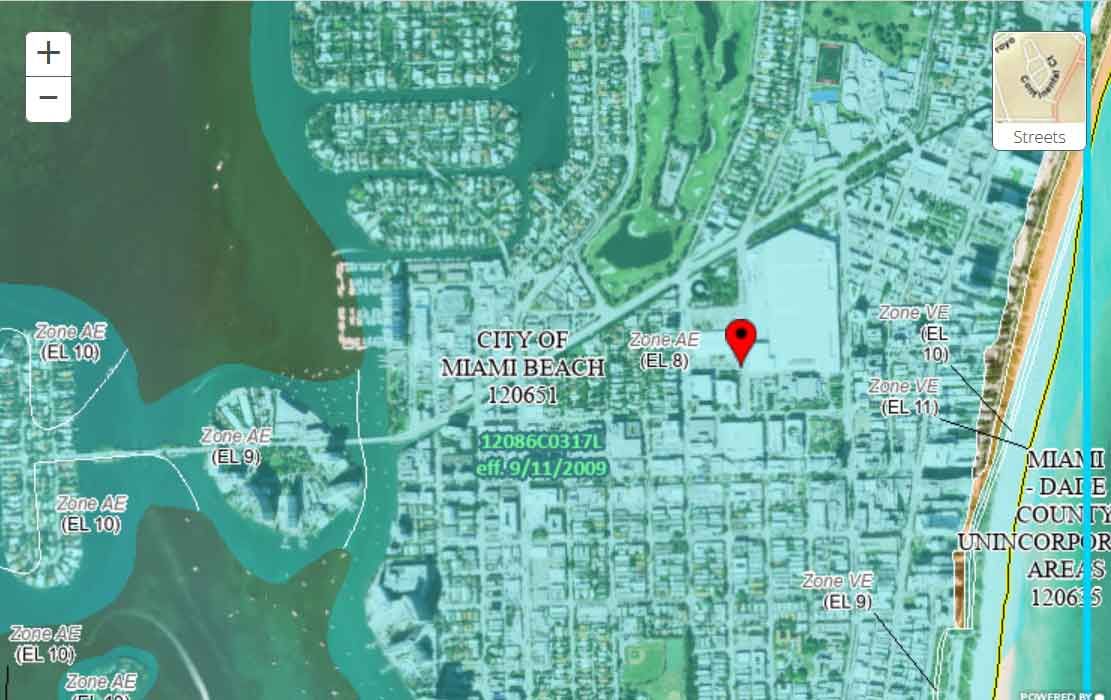

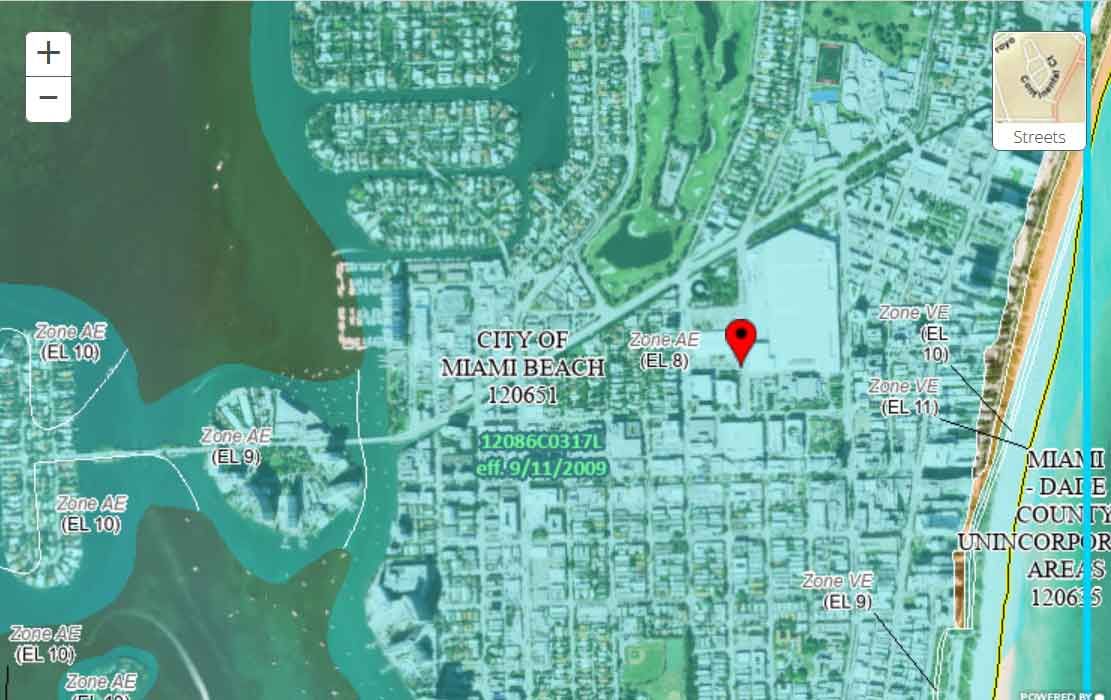

FEMA flood zone maps show the probability of flood risk across a geographical area. There are Flood Insurance Rate Maps (FIRMs) and Flood Hazard Boundary Maps. The zones that they depict reflect the severity of flooding in a particular area. More than 20,000 communities in the United States have been placed into flood zone categories.

It is a good idea to research flood risk for your current or potential properties. Not all states require sellers to share flood risk information or reveal previous flooding or leakage to buyers. You can locate your flood map using your street address through the FEMA Flood Map Service Center, or you can assess all your current as well as future climate risks with the ClimateCheck property report. For more information on reading a flood zone map, see our full FEMA flood maps guide which describes the terminology of flood maps, how to use them, and their connection to the National Flood Insurance Program (NFIP).

The Importance of FEMA Flood Zones

Your flood zone can provide crucial information on the physical and financial risks to your property as a result of flood. Unfortunately, FEMA flood maps often struggle to fully account for changes in flood patterns due to climate change. The maps are also unable to account for pluvial surface flooding caused by intense rainfall. The type of flood zone that you are in affects the cost of flood insurance policies and flood insurance is mandatory in some flood zones. Special Flood Hazard Areas (SFHAs) are the areas that are at the greatest risk of flooding, mudflow, or flood-related erosion.

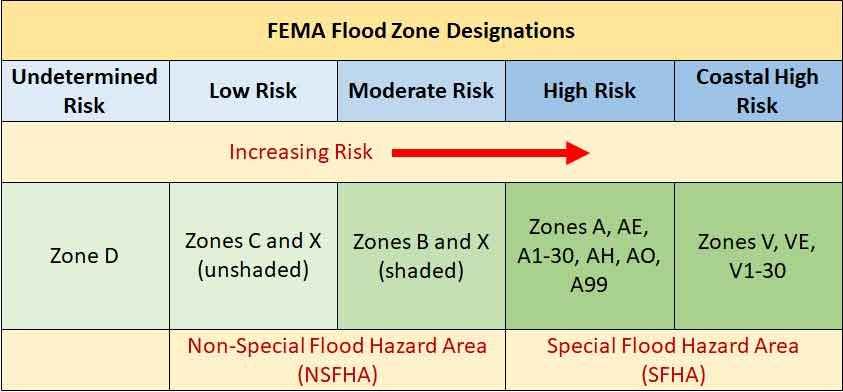

High risk areas are started by either “A” or “V”, low and moderate flood risk areas begin with “B”, “C”, or “X”. “D” labels undetermined flood zones, where flood risk exists but is unmeasured. To better understand what each flood zone means for a property’s likelihood of flood, FEMA maps often use the terminology of “100 and 500-year flood zones”. A 100-year flood area is one in which there is a 1% annual chance of flood and a 500-year flood corresponds to a 0.2 percent chance on average. More explanation of much of this information on flood zone categories can be found on government flood resources.

Low and Moderate Risk Areas (FEMA Zones B, C, X)

In these areas, flood risk is present, but reduced from the intensity of high risk areas. These zones are not considered a part of the Special Flood Hazard Area, and are otherwise known as Non-Special Flood Hazard Areas (NSFHAs).

Although these areas typically have less than a one percent chance of flooding each year, it is still a good idea to be wary of flood dangers in these zones. One in five insurance claims come from low and moderate risk areas; these areas receive one-third of federal disaster assistance. Federal flood insurance is not required in these areas, but it is recommended for all property owners and managers.

- Flood Zones B and X (Shaded)

Areas with a moderate flood hazard between the 100 and 500-year flood levels. “B” zones describe base flood plain areas with “lesser” hazards, such as areas protected by dams, dikes, levees, or shallow flooding areas with average depths of less than a foot etc. - Flood Zones C and X (Unshaded)

Areas with a minimal flood hazard above the 500-year flood level. “C” zones may have ponding or drainage issues. “X” zones are areas outside the 500-year flood and protected by levees from 100-year flood.

High Risk Areas (FEMA Zone A)

High risk flood areas have a 1 in 4 chance of flooding during a 30-year mortgage, otherwise known as a 1% annual flood risk. “A” areas are typically located near ponds, streams, and rivers. These features increase the likelihood of flood waters damaging the surrounding area. Homes and properties within these areas are subject to mandatory flood insurance purchase requirements.

The Base flood elevation (BFE) is an important metric for high risk and coastal flood zones. It is the rise of surface water resulting from a flood that has a one percent chance of reaching or exceeding that level in any given year. In other terms, it helps to predict how high flood waters will rise in a particular location and elevation. The BFE is shown for zones: AE / A1-30, AH, AO, AR, and VE / V1-30.

- Flood Zone A

These areas have a 1% annual chance of flooding, and therefore a 25% chance over the life of a 30-year mortgage. Detailed analyses are not done on these areas and therefore no depths or base flood elevations are shown within “A” zones. - Flood Zones AE / A1-30

Base flood elevations are provided within these areas. In old format FIRMs, the base floodplain is shown in numbered A zones numbered from A1 to A30. - Flood Zone AH

Areas with a 1% annual chance of shallow flooding of, on average, 1 to 3 feet. Base flood elevations are shown. - Flood Zone AO

Areas with river of stream flood hazard with a 1% or greater chance of shallow flooding annually. Average flood depths are shown in these areas. - Flood Zone AR

Areas with a temporarily increased flood risk due to the restoration of a flood control system, such as a dike, levee or dam that has been decertified. Mandatory flood insurance purchase requirements apply. - Flood Zone A99

Areas subject to 1% annual flood risk but which are in the process of being protected by a Federal flood control system such as a dam, dike, or levee. “A99” indicates that enough progress has been made in the construction of protective measures that it is considered complete for the purpose of insurance rating. Depths and base flood elevations are not shown within these areas.

High Risk Coastal Areas (FEMA Flood Zone V)

Coastal areas are often the most hazardous of all flood zone areas. They can be subject to the direct force from storm surge waves which can cause extreme damages to property and wild coastline. Sea level rise due to climate change, as well as coastal subsidence in some areas, will induce increased flooding over time. For communities that participate in NFIP, mandatory flood insurance purchase requirements apply for all types of coastal zones.

- Flood Zone V

Coastal areas with a 1% or greater chance of flooding and with the additional hazard of storm waves. No base flood elevations are shown within these areas because detailed hydraulic analysis has not been performed. - Flood Zones VE / V1-30

Areas with all the characteristics of “V”, but with base flood elevations shown at selected intervals within these zones derived from hydraulic analyses.

Undetermined Risk Areas (D)

- Flood Zone D

Flood areas with an undetermined amount of risk. Flood insurance rates in these areas are likely to reflect the uncertainty of flood risk. Unfortunately, millions of homes have undisclosed flood risks, especially in minority communities. Insurance is not mandatory in these areas, but coverage is available.

Conclusion

Understanding the flood zones of an area before making an offer on a home can help you learn more about your potential flood risks and be better prepared for flood damage. If you feel a FEMA flood zone designation for your property is not correct, you can submit a Letters of Map Change (LMOC) form to request a review and update. Check your ClimateCheck score to learn more about your individual flood risk, including future risk from our changing climate.