Taking actions can help protect your property and investments from the disastrous effects of severe flood damage. There are many ways to help protect your property from flooding, ranging from easy and affordable to involved and expensive. Understanding which of these to apply is tied to your likely flood risk.

The National Flood Insurance Program (NFIP) provides building standards for flood resistance. Buildings that are constructed in compliance with these standards experience almost 80% less damage annually than non compliant buildings.

Purchasing flood insurance is an important first step in protecting any real estate asset. Flooding can occur almost anywhere and climate change is making floods more frequent and intense. Federal disaster assistance, which comes in the form of a low-interest FEMA loan, is only available if the flooded area is declared a natural disaster. It is therefore important to purchase insurance even if you are outside a FMEA designated high-risk flood zone. You can purchase NFIP flood insurance through your local agent. Don’t wait on purchasing insurance; policies typically go into effect 30 days after purchase.

Your Action Plan for Flooding

In the case of a flood, it is important to have a plan ready for your property, your family and your valuable possessions. Here are some tips:

- Sign up for your community’s emergency alert system.

- Create and maintain an emergency to-go kit. Select your chosen evacuation route and meeting point and make sure each family member knows the location.

- Store your most valuable or sentimental items on the highest floor possible. Make virtual or physical copies of your most important photos. Avoid using your basement as a living space.

- Consider purchasing a generator for use in the case that the power goes out. Install it so that it is elevated above likely flood levels. When in use, ensure that all electrical connections are safely above flood waters.

Flood Prevention and Resilence

Adaptation and resilience starts with knowledge about how your property is likely to be impacted by flooding. Obtaining your ClimateCheck property report is a great way of assessing your present and future risk. The FEMA flood maps are also a highly detailed and community-specific resource for understanding your flood risk. Flood risk to real estate is often measured using a FEMA metric called the Base Flood Elevation (BFE). The BFE describes the level floodwater is expected to reach during a flood event that has a one in one-hundred chance of occurring in any given year. See this guide for information on how to read and evaluate FEMA flood maps, and our article giving details on FEMA flood zone designations. Your local floodplain manager and emergency manager can give you additional information on the possible water hazards in your community.

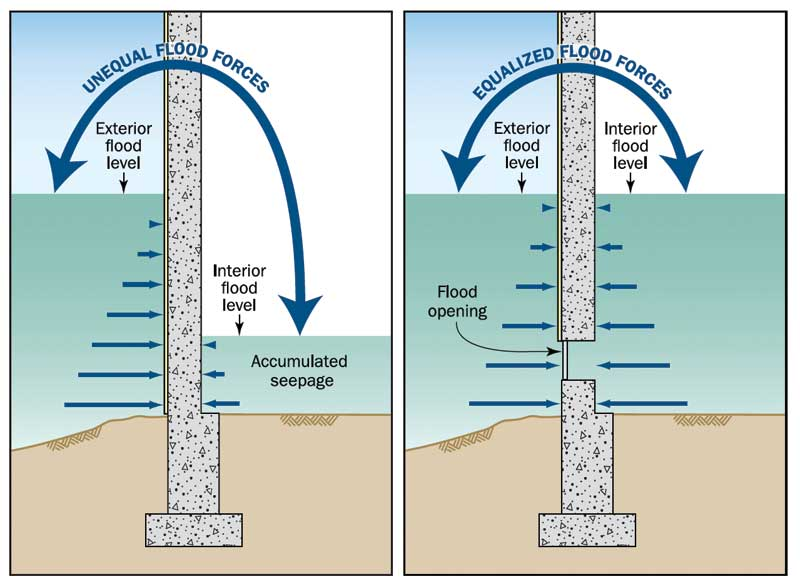

Flood prevention and adaptation options can be grouped into the two categories of “wet flood-proofing” and “dry flood-proofing”. Wet floodproofing allows flood waters to enter and flow through the enclosed areas of a house. In contrast, dry floodproofing seeks to prevent the entry of flood water entirely. The benefit of allowing waters to flood through your home can be to relieve pressure imposed on a home during floods and therefore reduce the likelihood of structural damage. Most adaptation options, however, fall into the category of dry floodproofing and water prevention.

Use the following checklist to see what adaptation and mitigation actions are appropriate for you:

Less Expensive Options

- Add waterproof veneer to your foundation, exterior walls, windows, and doorways to prevent shallow flooding from leaking in to damage your home and possessions. You can also seal your basement walls with waterproofing compounds.

- Use flood resistant non porous flooring materials, especially in areas of your house below the BFE. For example, replace carpet with tiles and use flood-resistant insulation and sheetrock.

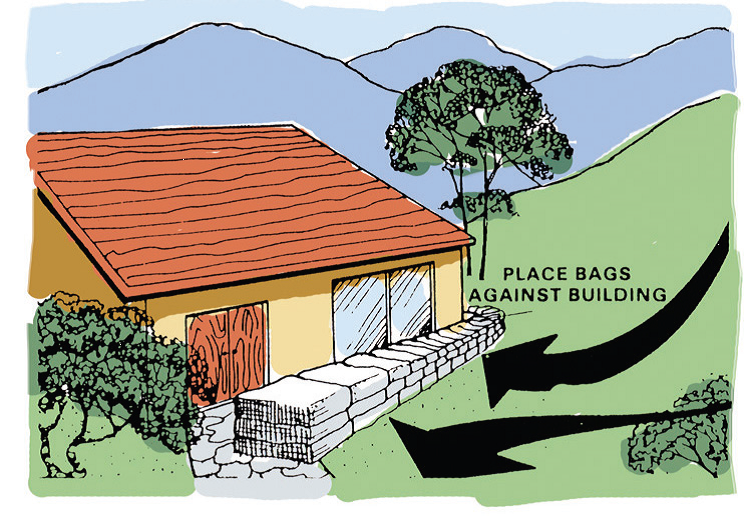

- Buy sandbags to divert moving water around buildings. Buy doorway flood barriers.

- Clear your gutters and be sure your downspouts route water away from your house to prevent water from pooling around your foundation.

- Keep storm drains near your property free from debris. If a drain is malfunctioning or draining irregularly, contact your municipal government.

- Purchase rain barrels; connect them to gutter downspouts to collect runoff and reduce flash flood risks.

- Install flood vents in foundation walls, garages, and other enclosed areas. Vents allow water to flow through a home or crawlspace instead of pooling and applying pressure to walls and windows which could result in major structural damage.

More Expensive Options

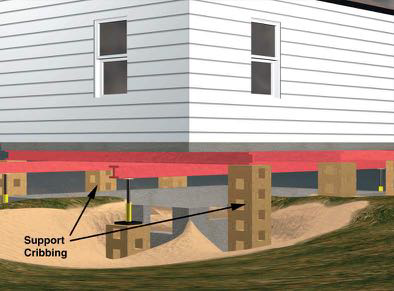

- Elevate the lowest floor of your home above the BFE using stilts or concrete blocks, or even relocate your home to higher ground. In addition to protecting your home from the risk of future flood levels, elevating can lower flood insurance premiums.

- Elevate or flood proof your HVAC system and other essential units, electrical systems, and utilities above the BFE. This can help reduce repair costs and help ensure that this important equipment functions in the case of a flood.

- Build in foundation vents to allow water to flow through areas that are not used as living space, such as the basement. This allows hydrostatic pressures inside the house to equalize with flood waters outside and thereby decrease the risk of structural damage.

- Install a sump pump to remove water if it accumulates in your home. The “sump” is a pit constructed in your basement or crawl space which collects water and holds the sump pump. The pump can automatically sense rising water and remove water using a discharge line.

- Install an exterior floodwall to protect utilities, window wells, or stairs against low level flooding. Construct from concrete or masonry and make sure to secure to the footing.

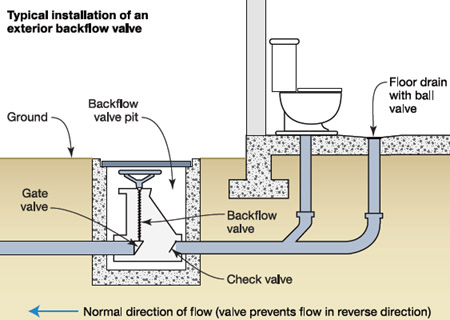

- Have a backflow check valve installed on your sewer or storm drain connection to prevent backflow during flooding, and clean it regularly. This helps reduce home flooding during a storm event.

- Explore land grading options, especially for new construction. Land grading reforms the surface of the land to better direct water away from your home or building. Swales are a highly effective means of directing water using landscaping.

- Anchor your fuel tank securely with non-corrosive metal structural supports and fasteners. Flood waters can cause fuel tanks to tip over or float which may result in spills or fires.

Community Preparation

Many of the most important flood protection efforts can be made at the community level. Community-wide flood risk management efforts like restoring and protecting ecosystems and adding green space to improve water retention can make a huge difference to the flood risk of an area.

Creating an action plan for flooding and investing in mitigation for your property contributes towards your community’s flood preparedness. In addition, individuals can take actions to reduce strain on shared community resources during storms. Taking these actions collectively as a community can change flood outcomes for your home. For example, reduce the amount of storm water you are putting into the municipal sewer system. The more stress placed on the system, the greater chances that the community drainage system will get overwhelmed and cause flooding.

Required Flood Mitigation

The National Flood insurance Program is a federally supported flood insurance program which makes coverage available to homeowners, renters, and business owners. It requires flood insurance in all high-risk areas. In addition, they encourage homeowners to use flood adaptation and mitigation options. Planning as a community for flood is worth it; the cost of flood damage nationwide has been reduced by nearly $1 billion a year through the implementation of floodplain management requirements and the use of flood insurance plans.

Local officials may determine that your home falls within an area that is likely to be substantially or repetitively damaged by flood. In this case, you may be required to make changes to the structure of your home to bring it into compliance with floodplain management ordinances. In this case, you may be able to utilize coverage called Increased Cost of Compliance (ICC) to provide up to $30,000 in financial assistance for flood adaptation repairs.

Recovering from Flood Damage

After your home has weathered a flood, it is still important to act carefully to ensure the safety of your home and family during cleanup. Make sure that you approach your home with caution. You may be faced with the danger of electrical hazards, structural damage, and falling objects. Flooding may have caused hazardous materials like oil and chemicals to be deposited by flood waters. In addition, standing water for more than 24 hours can cause the growth of biological hazards such as bacteria, viruses, molds and mildew on your carpets and other porous surfaces. If you plan to make an insurance claim, make sure that you remember to take photos of structural and personal property damage inside and outside your home before you start the cleanup process.

Conclusion

Flooding can happen almost anywhere. It is therefore important to use a mix of adaptation and insurance coverage to protect yourself from flood risk that has become more extreme with climate change. Often properties are affected by several kinds of extreme weather throughout the year; learn to protect your home from other types of extreme climate risk.